Bitcoin, the world’s most well-known cryptocurrency, operates on a decentralized network where miners use powerful computers to solve complex mathematical problems. For their efforts, miners are rewarded with newly minted bitcoins. However, this reward does not stay constant. Every 210,000 blocks, or roughly every four years, this reward is halved in an event aptly termed the “Bitcoin Halving.” impacting BTC price today. Let’s delve into its significance and effects.

Key Points about Bitcoin Halving:

- Purpose: The halving ensures that Bitcoin remains deflationary, capping its total supply at 21 million coins.

- Supply Reduction: The issuance rate of new bitcoins is halved, meaning fewer bitcoins are introduced into circulation.

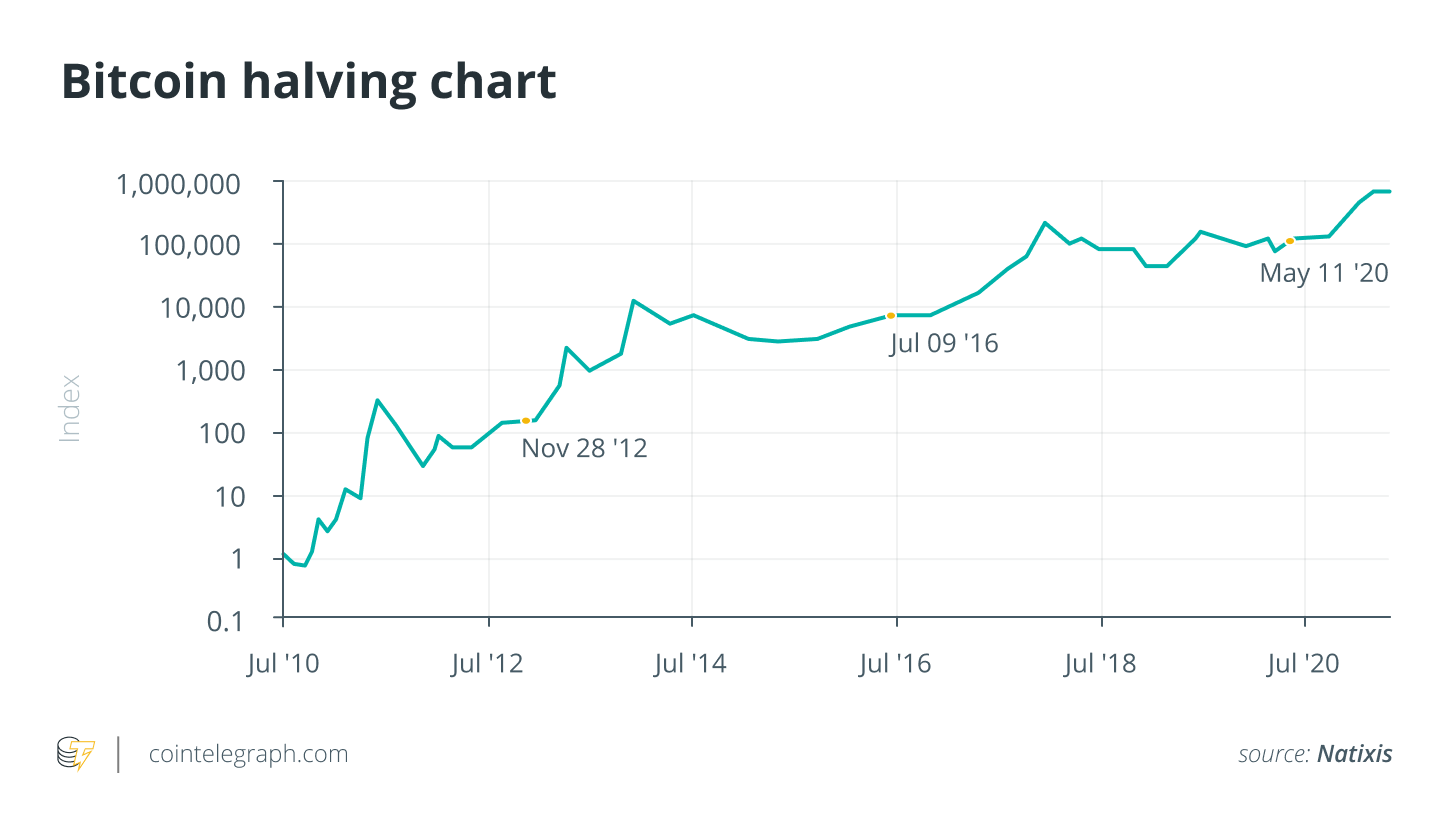

- Historical Impact: Historically, halvings have led to significant price volatility, typically seeing a price surge in the months that follow.

- Mining Impact: With each halving, mining profitability may decrease in the short term unless there’s a compensatory increase in Bitcoin’s price.

- Inflation Rate: Bitcoin’s inflation rate is reduced after every halving, making it scarcer over time.

Historical Bitcoin Halvings:

| Halving Year | Block Number | Reward Before Halving | Reward After Halving |

|---|---|---|---|

| 2012 | 210,000 | 50 BTC | 25 BTC |

| 2016 | 420,000 | 25 BTC | 12.5 BTC |

| 2020 | 630,000 | 12.5 BTC | 6.25 BTC |

| 2024 | 840,000 | 6.25 BTC | 3.125 BTC |

Implications of the Bitcoin Halving:

- Price Volatility: Due to the reduced rate of Bitcoin supply, demand dynamics can lead to price surges.

- Miner’s Revenue: Miners’ revenue may decrease immediately after the halving unless there’s a price increase. Some less efficient miners might leave the network, leading to a temporary decrease in the network’s hash rate.

- Network Security: While reduced miner participation might pose short-term security concerns, the adaptive nature of Bitcoin’s difficulty adjustment ensures that the network remains secure.

- Increased Scarcity: Over time, as the inflation rate decreases, Bitcoin becomes an even scarcer asset, potentially increasing its demand as a store of value.

For those interested in an in-depth analysis of the upcoming event, refer to our comprehensive article on the Bitcoin Halving 2024.

Conclusion:

Bitcoin Halving is an integral aspect of the Bitcoin network, ensuring its deflationary characteristic and predictable monetary policy. While short-term impacts like price volatility and miner participation can be observed, in the long run, halving events underscore Bitcoin’s value proposition as a scarce, decentralized digital asset.